Bancassurance

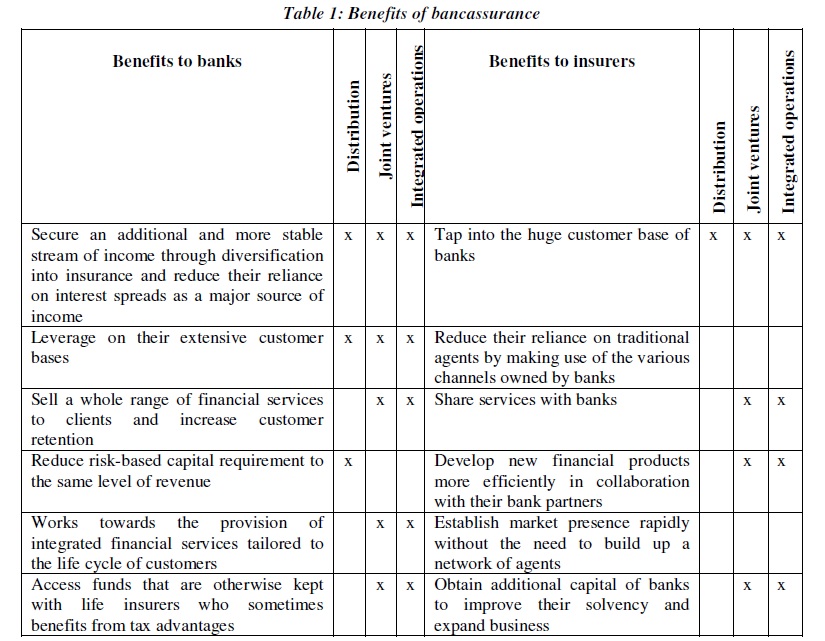

Successful bancasurance models have thus far primarily involved selling simplified products over the counter to customers who make on-the-spot decisions. Bancassurance products tend to complement existing bank products, which can in turn lead to additional selling opportunities. Worldwide, insurers have been successfully leveraging bancassurance to gain a foothold in markets with low insurance penetration and a limited variety of distribution channels. It is believed that the ability to integrate banking and insurance can help to lower costs and maximize synergies.

The economics behind integrated operations, however are being increasingly challenged by regulatory changes. New regulations have eliminated many of the capital advantages previously enjoyed by bancassurance. At the same time, the quest for additional growth has led some bancassurance to explore alternative business models. Some, for example, are beginning to focus exclusively on distribution, and are employing multi-supplier and multi-channels strategies.

The marketing of more complex products has also gained ground in certain countries, alongside a more dedicated focus on niche client segments and the distribution of non-life products. In many of these situations, significant re-engineering of existing marketing and back-office process is needed, particularly in areas such as claims management, due to higher claims frequency of non-life insurance products. Over the last two decades, bancassurance has become a key distribution channel in many insurance markets. Its prevalence is most pronounced in Southern Europe, but its use has also spread to other regions, in particular emerging markets.